Loading

Get Illinois Withholding Allowance Worksheet 2020 Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Illinois Withholding Allowance Worksheet 2020 Sample online

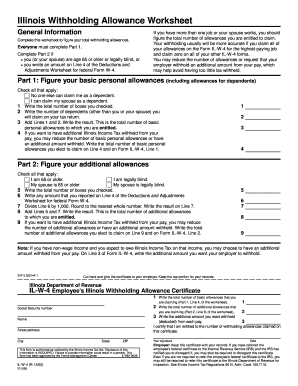

Completing the Illinois Withholding Allowance Worksheet 2020 Sample is essential for determining the appropriate amount of state income tax to withhold from your pay. This guide will walk you through each section of the form to ensure accurate completion.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the worksheet and open it in your preferred form editor.

- Begin with Part 1, where you will identify your basic personal allowances. Check all applicable boxes related to your dependency status and enter the total checked on Line 1. Next, specify the number of dependents you will claim on Line 2. Finally, sum the numbers from Lines 1 and 2 and write the result on Line 3, which represents your total basic personal allowances.

- If you wish to withhold additional Illinois income tax, you may choose to reduce your claimed allowances. Indicate the total you elect to claim on Line 4.

- Proceed to Part 2 to determine any additional allowances. Mark any applicable boxes indicating age or blindness, then tally these on Line 5. If you reported a specific amount on Line 4 of the Deductions and Adjustments Worksheet, write that amount on Line 6.

- Calculate Line 7 by dividing the amount on Line 6 by 1,000 and rounding to the nearest whole number. Add the result from Line 7 to the total from Line 5 for Line 8, which gives your total additional allowances.

- If you choose to have more income tax withheld, indicate your selected number of additional allowances on Line 9.

- Complete the certification section with your personal information, including your name, address, and Social Security number. Sign and date the form confirming the accuracy of the information provided.

- After finalizing the document, you can save your changes, download the form, print it, or share it as needed.

Complete your required documents online to ensure proper withholding and compliance.

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.