Loading

Get Form 2555

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2555 online

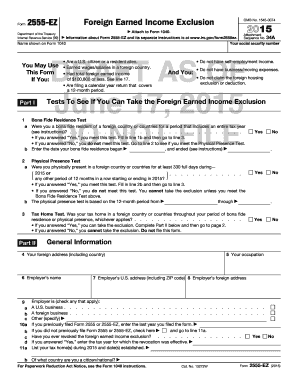

Filling out Form 2555 is essential for U.S. citizens and resident aliens who earned income abroad and wish to claim the foreign earned income exclusion. This step-by-step guide will help you complete the form accurately and efficiently.

Follow the steps to complete Form 2555 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I of the form. Indicate whether you meet the requirements to use this form by answering questions regarding your citizenship status, income levels, and the nature of your employment. Fill in all applicable sections.

- Next, determine if you meet the Bona Fide Residence Test or the Physical Presence Test. You will need to provide dates regarding your residency or physical presence in the foreign country.

- Complete Part II by providing general information such as your foreign address, occupation, and your employer's details. Ensure that all information is accurate and thorough.

- If applicable, fill out Part III, which requests details about your days present in the United States. Input the necessary dates and income as required.

- Proceed to Part IV to compute your foreign earned income exclusion. This section will guide you through determining the maximum exclusion you are eligible for based on your days in qualifying periods.

- Finally, review all sections for completeness and accuracy. Once you're satisfied with the information provided, save your changes, and choose to download, print, or share the completed form.

Start filling out your Form 2555 online today to ensure you maximize your foreign income exclusion benefits.

Generally, you report your foreign income where you normally report your U.S. income on your tax return. Earned income (wages) is reported on line 7 of Form 1040; interest and dividend income is reported on Schedule B; income from rental properties is reported on Schedule E, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.