Loading

Get Form Dp-165 - New Hampshire Department Of Revenue ... - Revenue Nh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DP-165 - New Hampshire Department Of Revenue online

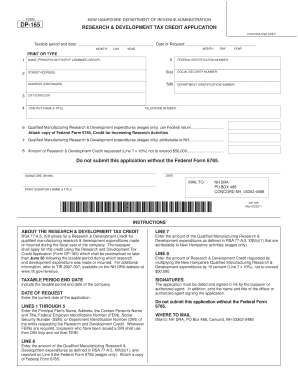

Filling out Form DP-165 is an essential step for individuals or businesses seeking to apply for the Research and Development Tax Credit in New Hampshire. This guide will provide you with clear and supportive instructions on how to complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editing tool.

- Begin filling out the form by entering the taxable period end date in the designated section. Ensure you provide the full month, day, and year.

- Provide your name as the principal New Hampshire filer, followed by your street address. If your address has multiple lines, complete them appropriately.

- In the next field, enter your Social Security Number or Department Identification Number, as applicable.

- Fill out the city, state, and zip code fields where you reside or your business operates.

- Enter the contact person's name and title, along with the Federal Identification Number associated with your organization.

- In Line 6, input the amount of qualified manufacturing research and development expenditures reported per your Federal return. Make sure to refer to the Federal Form 6765 for accuracy.

- Provide the qualified manufacturing research and development expenditures attributed to New Hampshire in Line 7.

- Calculate the amount of the research and development credit you are requesting by multiplying the value from Line 7 by 10% in Line 8. Note that this amount should not exceed $50,000.

- Date the application, sign it in ink, and print the name and title of the individual who signed.

- Mail the completed form along with the Federal Form 6765 copy to the New Hampshire Department of Revenue Administration at the address provided.

Complete the Form DP-165 online today and take a step towards securing your Research and Development Tax Credit.

A Power Of Attorney (POA) is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer. All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.