Loading

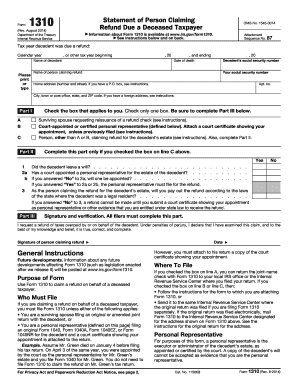

Get Form 1310 (rev. August 2014). Statement Of Person Claiming Refund Due A Deceased Taxpayer - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1310 (Rev. August 2014). Statement of Person Claiming Refund Due a Deceased Taxpayer - IRS online

Filling out Form 1310 is an essential step for claiming a refund on behalf of a deceased taxpayer. This guide will provide step-by-step instructions to ensure that you complete the form accurately and efficiently, helping you navigate the online process smoothly.

Follow the steps to complete the Form 1310 effectively.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the tax year for which the decedent was due a refund in the designated fields. Specify whether it pertains to the calendar year or another tax year.

- Provide the name and social security number of the decedent, along with their date of death. This information is crucial for processing the claim.

- Fill in your name and social security number as the person claiming the refund. Make sure to enter your home address clearly.

- In Part I, check only one box that applies to your situation: 'A' for a surviving spouse, 'B' for a court-appointed personal representative, or 'C' for any other person claiming the refund. Complete Part III if the box checked is 'A' or 'B'.

- If you selected option 'C', complete Part II by answering questions regarding the decedent's will and appointment of a personal representative. Ensure that all relevant fields are filled out.

- In Part III, sign and date the form, affirming that the information provided is true and complete. This section is essential for the verification of your claim.

- Once you have reviewed everything for accuracy, you can save your changes, download the completed form, print it for your records, or share it as necessary.

Start filling out Form 1310 online today to ensure a smooth claim for the refund due to a deceased taxpayer.

Representatives who aren't court-appointed must include Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer to claim any refund. Surviving spouses and court-appointed representatives don't need to complete this form. The IRS doesn't need a copy of the death certificate or other proof of death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.