Loading

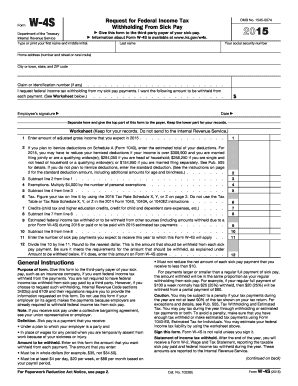

Get 2015 Form W-4s - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Form W-4S - IRS online

The 2015 Form W-4S is used to request federal income tax withholding from sick pay. This guide will provide clear, step-by-step instructions on how to effectively fill out this form online, ensuring you understand each component and what information to include.

Follow the steps to complete the 2015 Form W-4S online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Type or print your first name and middle initial in the designated field.

- Enter your last name as it appears on your identification.

- Fill in your social security number in the appropriate section.

- Provide your home address, including the number and street or rural route, city or town, state, and ZIP code.

- If applicable, enter your claim or identification number.

- Indicate the amount you wish to have withheld from each sick pay payment, ensuring it meets the minimum requirements of whole dollars.

- Sign and date the form to validate your request.

- Separate the form by cutting along the designated line. Give the top part to the payer of your sick pay and retain the lower part for your records.

- Review your entries for accuracy, then save your changes, download the document, print it, or share as required.

Complete your forms online to ensure accurate and timely processing.

Step 1: Enter your personal information. In this section you'll enter your name, address, filing status and Social Security number. ... Step 2: Complete if you have multiple jobs or two earners in your household. ... Step 3: Claim Dependents. ... Step 4: Other Adjustments. ... Step 5: Sign your form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.