Loading

Get Form 71 661 13 8 1 000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 71 661 13 8 1 000 online

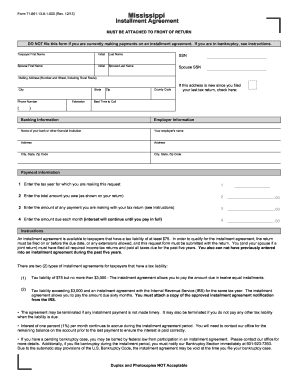

This guide will assist you in completing the Form 71 661 13 8 1 000 efficiently and accurately. By following the steps outlined below, you can ensure that your installment agreement request is processed smoothly and meets all necessary requirements.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to acquire the form and access it in your chosen online editor.

- Fill in the taxpayer's first name, initial, and last name in the appropriate fields.

- Enter the Social Security Number (SSN) for the taxpayer in the designated field.

- If applicable, provide the spouse's first name, initial, last name, and SSN.

- Input the mailing address, including the street number, city, state, county code, and zip code. Indicate if this address is new since your last tax return.

- Record the best time to contact you for any follow-up.

- In the banking information section, provide the name and address of your bank or financial institution.

- Complete the employer information by filling in the name and address of your employer.

- For payment information, enter the tax year for which you are making this request, the total amount owed, the payment amount you are making with your return, and the monthly payment amount.

- Review all entered information for accuracy and completeness before proceeding.

- Once satisfied with your entries, save changes, download a copy, print the form, or share it as necessary.

Start completing your Form 71 661 13 8 1 000 online today!

You must file a Mississippi Resident return and report total gross income, regardless of the source. You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.