Loading

Get Nd1qec Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nd1qec Form online

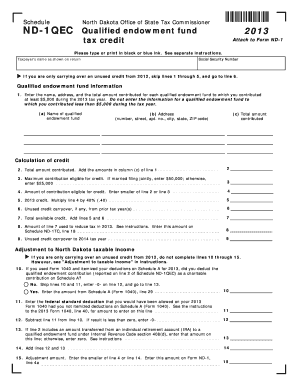

The Nd1qec Form is essential for claiming tax credits related to contributions made to qualified endowment funds. This guide provides clear and supportive instructions on how to complete the form online effectively, ensuring that all necessary details are accurately captured.

Follow the steps to fill out the Nd1qec Form online.

- Click ‘Get Form’ button to access the Nd1qec Form and open it for editing.

- Begin by entering the taxpayer's name as it appears on the tax return, and include the Social Security Number.

- If you are only carrying over an unused credit from 2012, skip lines 1 through 5, and proceed to line 6.

- Fill in the qualified endowment fund information by entering the name, address, and total amount contributed for each fund to which you contributed at least $5,000 during the tax year in the appropriate columns.

- Total the amounts in column (c) from line 1 and enter that number on line 2.

- On line 3, indicate the maximum eligible contribution for credit: $50,000 if filing jointly and $25,000 otherwise.

- On line 4, enter the smaller value between the total from line 2 and the maximum contribution eligible from line 3.

- Calculate the 2013 credit by multiplying the amount on line 4 by 40% and enter that on line 5.

- If applicable, enter any unused credit carryover from prior tax years on line 6.

- Add the amounts from lines 5 and 6 to determine the total available credit, and write this amount on line 7.

- Enter the amount from line 7 that will reduce the tax for 2013 on line 8, and if you have any remaining amounts, carry them over to 2014 on line 9.

- Fill out lines 10 through 15 if you had deductions on your 2013 Form 1040, ensuring to follow the specific instructions provided.

- Review all entries carefully to ensure accuracy before saving your changes. You can then download, print, or share the completed Nd1qec Form as needed.

Complete and submit your documents online for a seamless filing experience.

for the taxable year January 1, 2019 through December 31, 2019 or other taxable year: , 2019 through. , FORM 1040N.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.