Loading

Get Form 1099 Worksheet (pdf)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1099 Worksheet (PDF) online

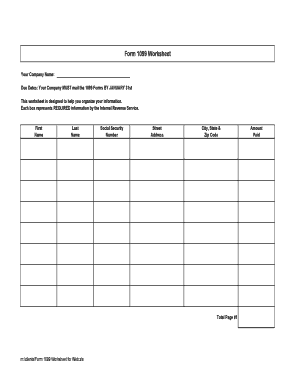

The Form 1099 Worksheet is an essential document for reporting income to the Internal Revenue Service. This guide will help you navigate the process of filling out this form accurately and efficiently online.

Follow the steps to complete the Form 1099 Worksheet seamlessly.

- Click the ‘Get Form’ button to obtain the form and open it in your chosen PDF reader.

- Begin by entering your company name in the designated field at the top of the form. This identifies the source of income being reported.

- Next, fill in the due dates. It is important to note that your company must mail the 1099 forms by January 31st.

- Use the worksheet provided to organize required information. Each box in the worksheet is designated for necessary details required by the Internal Revenue Service.

- Complete the personal information fields by entering the first name and last name of the recipient receiving the payment.

- Enter the social security number of the recipient, which is essential for tax reporting purposes.

- Provide the street address of the recipient, along with the city, state, and zip code. This information ensures accurate identification and correspondence.

- In the section for total amount paid, record the complete amount that was paid to the individual or entity during the tax year.

- Review all entered information for accuracy to prevent errors when filing. Accuracy is crucial for compliance with tax regulations.

- Once the form is completed, you can save any changes, download a copy for your records, print the document for mailing, or share it as needed.

Start completing your Form 1099 Worksheet online today!

Related links form

If you made a payment during the calendar year as a small business or self-employed (individual), you are most likely required to file an information return to the IRS. Receipt of certain payments may also require you to file an information return to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.