Loading

Get Fax Irs 8453 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fax Irs 8453 Form online

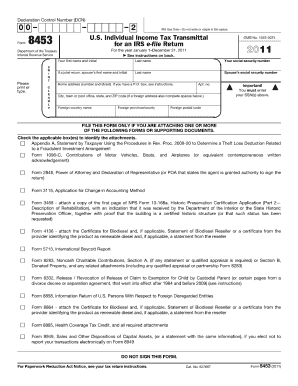

The Fax Irs 8453 Form is a crucial document for submitting tax returns electronically. Filling out this form accurately ensures that your tax information is properly submitted and processed by the IRS.

Follow the steps to successfully complete the Fax Irs 8453 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully enter your personal information in the designated fields. This typically includes your name, address, and Social Security number. Ensure all details are accurate to avoid delays.

- Provide your tax information as requested on the form. Enter the amount of taxes paid and any pertinent financial details. Double-check this information for accuracy.

- Sign and date the form electronically if required. Your signature confirms that the information provided is truthful and complete.

- Review all the sections to ensure that no fields are left blank and all information is correct.

- Once you have completed the form, you can save changes, download, print, or share the form as needed.

Complete your documents online now to ensure a smooth filing experience.

Submit by mail, FAX, or email, ing to the instructions on the Form 13909. Have information and want to claim a reward? Use Form 211, Application For Award For Original Information. Mail it to the address in the Instructions for the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.