Loading

Get Clear Form State Of Hawaii Department Of Taxation Schedule D1 (rev

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION Schedule D1 (Rev online)

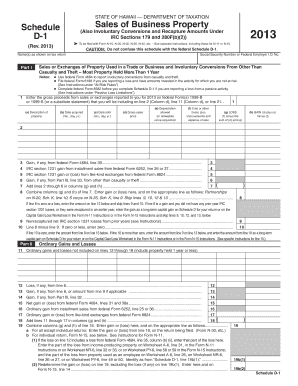

Filling out the Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION Schedule D1 (Rev) is crucial for accurately reporting the sales of business property. This guide will walk you through each section of the form, ensuring that you can complete it efficiently and correctly.

Follow the steps to fill out the Schedule D1.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name or names as shown on your tax return in the designated field at the top of the form.

- Enter your Social Security Number or Federal Employer I.D. Number in the respective section.

- In Part I, list the sales or exchanges of property used in a trade or business. Complete each column with the required information, including description, dates acquired and sold, gross sales price, depreciation, cost, basis, loss, and gain.

- Refer to relevant federal forms like Form 4684 for involuntary conversions due to casualty and theft, Form 6198 for reporting losses with amounts not at risk, and Form 8582 for passive activity losses before completing Schedule D1.

- Continue through the form by detailing any gains or losses from federal Form 4684, installment sales, or like-kind exchanges in the appropriate sections.

- Summarize your gains by adding the values in columns for each line as required. Carefully follow the instructions provided for each specific line.

- Review Part IV for any recapture amounts related to IRC Sections 179 and 280F(b)(2), filling in any necessary details.

- Once you have filled out all relevant sections, double-check for accuracy and completeness before proceeding.

- Finally, save any changes, download, print, or share the completed form as needed.

Complete your forms online today for a seamless filing experience.

Guidelines for Reproduced and Substitute Paper Tax Forms Office Location. 830 Punchbowl Street, Honolulu, HI 96813-5094. Open Hours. Email. Taxpayer.Services@hawaii.gov. Phone. 808-587-4242.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.