Loading

Get Self Employed Earners Form - Cornwall Council

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Self Employed Earners Form - Cornwall Council online

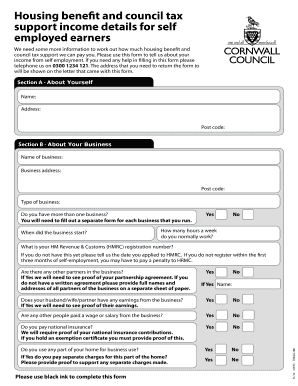

Filling out the Self Employed Earners Form for Cornwall Council can be straightforward when following a systematic approach. This guide is designed to provide clear instructions to assist you in completing the form accurately online.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor to begin the filling process.

- In Section A, provide your personal details. This includes your full name, residential address, and postal code. Be sure to write clearly.

- In Section B, describe your business. You’ll need to include the business name, address, and type, along with the date the business commenced. If you manage multiple businesses, keep in mind that a separate form is necessary for each.

- Indicate how many hours a week you typically work and provide your HM Revenue & Customs registration number. If you don't have one yet, mention the date you applied.

- Answer questions about partners in the business and provide proof of their agreement if applicable. If you pay wages or salaries from your business, indicate this as well.

- In Section C, state whether you have your latest self-assessment tax calculation and include it if available. Mention if you have separate business bank accounts and submit the past two months' statements.

- If you do not have accounts prepared by an accountant, proceed to Section D. In this section, you should provide your income and expenditure information as it relates to your business activities.

- In Section E, disclose any other financial outgoings, such as national insurance contributions and personal pension contributions. Be accurate and provide necessary proof for the figures entered.

- Finally, in Section F, read and understand the declaration. Confirm the information you provided is correct by signing and dating the form.

- After completing all sections, save your changes. You can then download, print, or share the form as needed.

Complete your Self Employed Earners Form online today to ensure your housing benefit and council tax support is accurately assessed.

If you are recognised as a 'self-employed' person, and have a 'right to reside' you will be entitled to most in-work benefits immediately e.g. you will be entitled to claim Working Tax Credit, Housing Benefit, Child Benefit and Child Tax Credit all the time that you are in work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.