Loading

Get Instructions For Qildro Form - Imrf - Imrf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For QILDRO Form - IMRF - Imrf online

Completing the Instructions For QILDRO Form - IMRF - Imrf is a crucial step for individuals seeking to manage their retirement benefits in accordance with Illinois law. This guide provides a detailed walkthrough to help users navigate each section of the form effectively and accurately.

Follow the steps to fill out the QILDRO form correctly.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

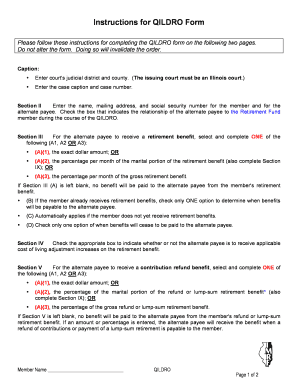

- In the caption section, enter the court's judicial district and county, ensuring that it is an Illinois court. Also, include the case caption and the case number.

- In Section II, provide the name, mailing address, and social security number for both the member and the alternate payee. Check the box indicating the relationship of the alternate payee to the member during the QILDRO.

- Move to Section III and select ONE of the following for the alternate payee to receive a retirement benefit: (A)(1) the exact dollar amount; (A)(2) the percentage per month of the marital portion of the retirement benefit; or (A)(3) the percentage per month of the gross retirement benefit. Complete the respective subsections as necessary.

- If applicable, check one option in Section III (B) to indicate when benefits will be payable to the alternate payee, and ensure Section III (C) is completed if the member does not yet receive retirement benefits.

- In Section IV, check the box indicating whether the alternate payee is to receive applicable cost of living adjustments on the retirement benefit.

- In Section V, repeat the selection process as in Section III but for contribution refund benefits, ensuring to complete one of the options for the amount or percentage.

- Section VI requires a selection similar to the previous sections, this time for any partial refunds.

- In Section VII, select the appropriate option for death benefits for the alternate payee, again ensuring to complete only one of the options.

- Complete Section IX if using percentage options in previous sections, calculating marital portion benefits as described.

- Finally, ensure that the form is signed and dated by the issuing judge.

- After all sections are filled, save your changes, and choose to download, print, or share the completed form as required.

Start filling out your QILDRO form online today to ensure accurate retirement benefit management.

Social Security and IMRF At retirement, generally you are entitled to full benefits from both. Your IMRF benefits are never reduced because you receive Social Security benefits. Your Social Security benefits generally are not reduced because you receive IMRF benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.