Loading

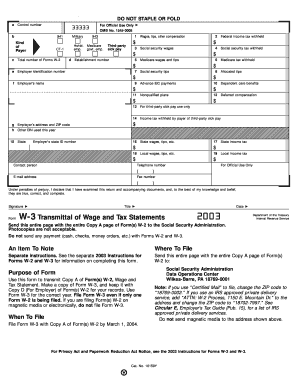

Get 2003 Form W-3 - Internal Revenue Service - Irs Treas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2003 Form W-3 - Internal Revenue Service - Irs Treas online

The 2003 Form W-3 is used to transmit Wage and Tax Statements (Form W-2) to the Social Security Administration. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the 2003 Form W-3 correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the top section, fill out the control number, kind of payer, and the establishment number as required. Ensure accuracy to avoid any issues with processing.

- Provide your employer's name, address, identification number, and any other EIN used this year. This information is critical for proper identification.

- Next, enter the total number of Forms W-2 that you are submitting. Each form submitted should correlate to this total; make sure to double-check your numbers.

- Complete the wage and tax information, including wages, tips, social security wages, and tax amounts withheld. Ensure that these figures match those reported on the W-2 forms.

- Fill in any applicable state and local wage information, including state income tax withheld, to ensure comprehensive reporting.

- At the bottom of the form, you will need to provide the contact person’s name, telephone number, email address, and fax number for any inquiries related to this filing.

- Review all entries for accuracy and completeness. It may be helpful to print a draft of the form for your records before final submission.

- Finally, save your changes, then download, print, or share the completed form as needed. Make sure to retain a copy for your records before submitting the form to the Social Security Administration.

Complete your forms online to ensure timely and accurate submission.

Box 1 wages, tips, other compensation contains an employee's total wages subject to federal income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.