Loading

Get Employment Tax Returns For Household Employers (forms 942, 940, 940-ez, Etc - Stuff Mit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employment Tax Returns For Household Employers (Forms 942, 940, 940-EZ, Etc - Stuff Mit online

Filling out the Employment Tax Returns for Household Employers can seem daunting, but this guide breaks down the process into manageable steps. Whether you are a new employer or looking to update your information, following these detailed instructions will ensure your form is completed correctly.

Follow the steps to successfully complete your employment tax returns online.

- Click ‘Get Form’ button to download the form and open it in the editor.

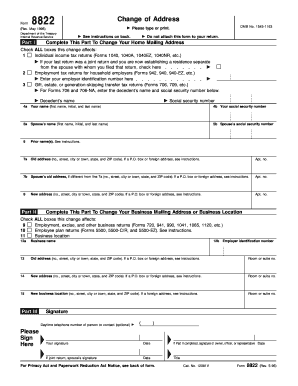

- Begin with Part I of the form, where you will indicate changes to your home mailing address. Check all boxes that this change affects, especially the box labeled 'Employment tax returns for household employers.' Enter your employer identification number in the designated field.

- Fill in your name and social security number in the appropriate sections, along with your spouse's information if applicable. Ensure you provide the old address, and the new address clearly, following the format of number, street, city, state, and ZIP code.

- Proceed to Part II if you need to update your business mailing address or business location. Similar to Part I, you will need to check all applicable boxes and fill in the required fields accurately, including the business name and both old and new addresses.

- In Part III, include your employer identification number and sign where indicated. Your signature confirms the accuracy of the information provided.

- Review all entries for accuracy, ensuring there are no missing or incorrect fields. It is important to verify that all details reflect your current information.

- Once completed, save your changes to the form. You can also download, print, or share the completed form as needed.

Take the next step in your documentation by completing the Employment Tax Returns for Household Employers online today.

Related links form

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.