Loading

Get Wtp 10005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wtp 10005 online

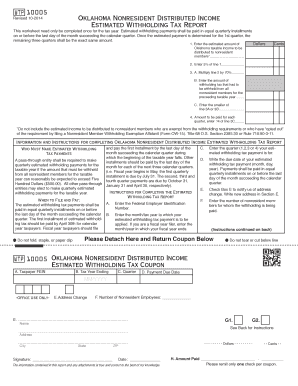

The Wtp 10005 is an essential form for reporting estimated withholding tax for nonresident distributed income in Oklahoma. This guide offers clear, step-by-step instructions on how to complete the form online, ensuring compliance with tax obligations.

Follow the steps to fill out your Wtp 10005 accurately.

- Press the ‘Get Form’ button to obtain the Wtp 10005 document and open it in your preferred editor.

- Enter the Federal Employer Identification Number (FEIN) in the designated field.

- Fill in the appropriate month and tax year for your estimated withholding tax payment.

- Specify the quarter for which the estimated withholding tax payment applies (1, 2, 3, or 4).

- Write the due date for your payment in the format of month, day, and year.

- If there has been an address change, check the box in Section E and provide the new address.

- Indicate the number of nonresident members for whom the withholding is being paid.

- Confirm if all nonresident members have signed a withholding exemption affidavit or if you no longer have nonresident members.

- Enter the total amount of estimated withholding tax that you are paying.

- Review all entered information for accuracy and completeness.

- Save your changes, then download, print, or share the completed form as required.

Complete your Wtp 10005 form online today to ensure timely and accurate tax reporting.

Penalty for failure to pay the tax withheld when due is 10% of the amount of tax, or 10% of the amount of underpayment of tax, if not paid on or before the due date (20th day of the month when due).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.