Loading

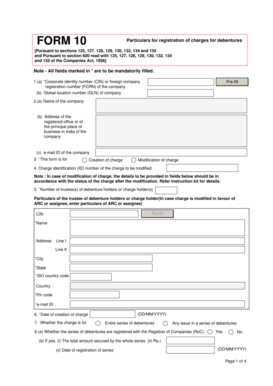

Get Form 10 Particulars For Registration Of Charges For Debentures Pursuant To Sections 125, 127, 128

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 10 particulars for registration of charges for debentures online

Filling out the FORM 10 for the registration of charges for debentures is an important process for companies and individuals involved in financial transactions. This guide provides clear, step-by-step instructions to ensure that all necessary details are accurately entered online.

Follow the steps to complete your FORM 10 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering the corporate identity number (CIN) or foreign company registration number (FCRN) of the company in the appropriate field. This information is crucial for identification purposes.

- Input the global location number (GLN) of the company, followed by the name of the company and the address of its registered office or principal place of business in India, along with the company’s email ID.

- Select whether this form is for the creation or modification of a charge. If modifying, ensure to include the charge identification (ID) number of the charge being modified.

- Indicate the number of trustees of debenture holders or charge holders. Fill in the relevant particulars of the trustee, including their CIN, name, address, city, state, country, email ID, and pin code.

- Enter the date of creation of the charge and specify whether the charge is for the entire series of debentures or any particular issue in a series.

- If the series of debentures are registered with the Registrar of Companies (RoC), select 'Yes' and provide the total amount secured by the whole series and the date of registration.

- Fill in the date of the present issue of the series and the amount secured by the charge. This includes entering the amount in both numeric and word format.

- Provide the date of the resolution authorizing the issue of the series and describe the categories of the property charged, specifying if it includes immovable properties, book debts, etc.

- Summarize the principal terms and conditions related to the charge, including the rate of interest and any redemption terms.

- Indicate particulars regarding any commission or discount paid, followed by details about modifications, if applicable, including dates and descriptions.

- Attach the required documents, including a copy of the resolution authorizing the debenture issue and the instrument of creation or modification of the charge.

- Verify all entered information for accuracy, ensuring all details are correct and in alignment with company records before final submission.

- Once completed, save your changes. You can then download, print, or share the filled form as necessary.

Start filling out your FORM 10 online for a smooth registration process.

The issuing of debentures follows a process which is similar to that of issue of shares by a company. There will be issuing of prospectus, applications will be invited from interested parties and there will be issuing of letters of allotment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.