Get Form St-121:1/11: Exempt Use Certificate, St121 - Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

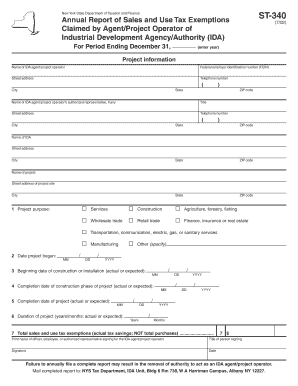

How to use or fill out the Form ST-340: Annual Report of Sales and Use Tax Exemptions online

Filling out the Form ST-340 is essential for the annual reporting of sales and use tax exemptions claimed by agents or project operators of Industrial Development Agencies in New York. This guide will provide you with a comprehensive, step-by-step approach to completing the form online, ensuring that the necessary information is accurately provided to comply with reporting requirements.

Follow the steps to successfully complete the Form ST-340 online.

- Click the ‘Get Form’ button to access the form and open it in your web browser or document editor.

- Begin by entering the project information at the top of the form. Input the year to specify the reporting period as well as the name, street address, telephone number, and federal employer identification number (FEIN) of the IDA agent or project operator.

- Next, provide the name and contact information of the authorized representative, if applicable. Include their title, street address, and telephone number.

- Complete the section detailing the name and address of the IDA involved in the project.

- Fill in the specific name and address of the project site.

- For Line 1, indicate the purpose of the project by checking the appropriate box. If selecting 'Other', provide a clear specification of the purpose.

- Enter the date the project began in MM/DD/YYYY format for Line 2.

- For Line 3, state the actual or expected beginning date of construction or installation.

- On Line 4, specify the completion date of the construction phase of the project.

- Record the expected or actual completion date of the entire project on Line 5.

- For Line 6, indicate the total duration of the project in years and months.

- In Line 7, enter the total amount of sales and use tax exemptions claimed during the reporting period. Ensure this amount reflects actual tax savings.

- At the signature area, provide the name, title, and date of the person authorized to sign.

- Finally, review all entries for accuracy. Once confirmed, you may save changes, download, print, or share the completed form as needed.

Complete your Form ST-340 online today to ensure compliance with New York State Tax regulations.

Businesses can apply for certificates that exempt them from paying sales tax on certain items. These certificates are issued by the New York State Department of Taxation and Finance (DTF). Businesses complete the certificate, and provide it to the vendor. The vendor keeps the certificate and makes a sale without tax.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.