Loading

Get Form 4va

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4va online

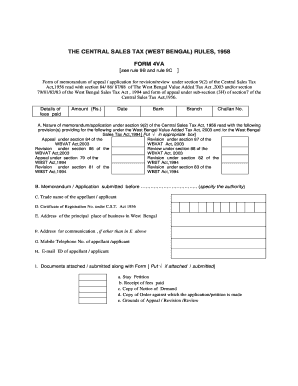

Filling out Form 4va correctly is essential for submitting a memorandum of appeal or application for revision under the applicable tax acts. This guide provides a step-by-step approach to assist users in completing the form online, ensuring accuracy and efficiency.

Follow the steps to fill out Form 4va seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing details about the fees paid. Enter the fee amount in Rs., the date of payment, and the bank and branch details along with the challan number.

- In section A, indicate the nature of your memorandum/application by placing a checkmark in the appropriate box for either an appeal or revision.

- Fill in section B with the name of the authority to which the memorandum/application is submitted.

- Enter the trade name of the appellant or applicant in section C.

- Complete section D with your Certificate of Registration Number under the Central Sales Tax Act, 1956.

- Provide the address of the principal place of business in West Bengal in section E. If the communication address differs, fill it out in section F.

- Input the mobile telephone number and email ID of the appellant/applicant in sections G and H, respectively.

- In section I, indicate the documents attached by placing a checkmark next to each applicable item, such as the stay petition, receipt of fees paid, and copies of relevant notices or orders.

- Move to section J and provide particulars relevant to the memorandum of appeal or application for revision/review, including assessment case numbers and periods of assessment.

- In section K, outline particulars relevant to the provisional assessment or any other assessment, detailing sales turnover and amounts admitted to be payable.

- Continue in section L with details regarding any orders imposed, including penalty orders and amounts of demand.

- In section M, summarize the payments made in respect of the relevant orders. Provide a comprehensive breakdown of amounts and dates.

- State the total amount collected as tax under the CST Act, 1956 in section N.

- In section O, clearly state the grounds for your appeal or revision, attaching additional sheets if necessary.

- Complete the verification section by declaring that all taxes and related amounts have been paid in full, and provide the required signature and personal details including name and status.

- Finally, review all sections for completeness and accuracy. Save your changes, then proceed to download, print, or share the completed form.

Ensure that you complete your Form 4va online today to avoid delays in processing your appeal or application.

Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.