Loading

Get P11d 2013 14 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P11d 2013 14 Form online

Completing the P11d 2013 14 Form online can streamline the process of reporting taxable benefits and expenses. This guide provides step-by-step instructions to help you accurately fill out the form and ensure compliance with HM Revenue and Customs requirements.

Follow the steps to complete the P11d 2013 14 Form online

- Click the ‘Get Form’ button to access the P11d 2013 14 Form online. This will allow you to open the document in the editor.

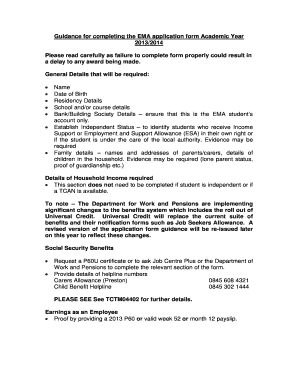

- Enter your personal details in the relevant sections. This includes your name, date of birth, residency details, and bank/building society information using only the EMA student’s account.

- If applicable, establish your independent status by indicating whether you receive Income Support or Employment and Support Allowance, and provide any required evidence.

- Fill in family details including names, addresses of parents/carers, and details of children in your household. Ensure to provide evidence for lone parent status or proof of guardianship if necessary.

- Provide details of household income. Note that this section can be skipped if you qualify as independent or if you have a TCAN.

- Enter earnings as an employee by providing proof, such as a 2013 P60 or a valid payslip. Deduct any relevant expenses that arose from your work.

- If self-employed, report your profit accurately according to your Tax Return form. Note any deductions for; pension contributions, charity payments, or averaging amounts as applicable.

- Detail any benefits received from your employer, including taxable vouchers, payments in kind, and benefits in kind, rounding the total to the nearest pound.

- Complete sections for miscellaneous income including property income, trust income, and foreign income, ensuring to provide evidence where required.

- Once all sections are completed, review your entries for accuracy. You can then save your changes, download the form, print it, or share it as needed.

Complete your P11d 2013 14 Form online today for a seamless reporting experience.

A P11D form is a document used by an employer to list any expenses or benefits given to directors or employees. It is submitted to HMRC yearly and includes items or services such as private healthcare, company cars or season ticket loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.