Loading

Get State Form 43760 - Intuit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 43760 - Intuit online

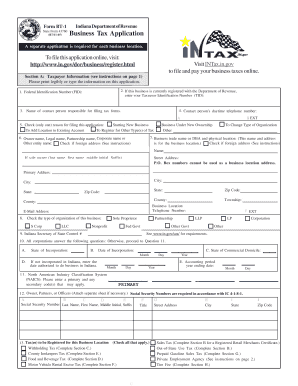

Filling out the State Form 43760 is an essential step for businesses registering for various tax types in Indiana. This guide will provide you with a clear and detailed walkthrough for completing this form online, ensuring that you understand each section and can submit your application effectively.

Follow the steps to complete the State Form 43760 - Intuit online

- Press the ‘Get Form’ button to access the State Form 43760, making sure to open it in your document editor for completion.

- In Section A, Taxpayer Information, carefully type or print your Federal Identification Number (FID) and, if applicable, your Taxpayer Identification Number (TID). Make sure to provide the daytime telephone number and name of the contact person responsible for filing tax forms.

- Next, check the appropriate box that indicates the reason for filing this application. Options include starting a new business, adding a location, or changing the type of organization.

- Complete the business name and address fields in Section A. If applicable, indicate that you have a foreign address by checking the appropriate box.

- Select the type of organization under which your business operates (e.g., Sole Proprietor, LLC, Corporation). This is critical for determining your tax obligations.

- If registering as a corporation, provide additional details about your state of incorporation and date of incorporation.

- Fill in the North American Industry Classification System (NAICS) code that best describes your business activities to ensure proper classification.

- Complete the sections relevant to the taxes you are registering for. Review each check box carefully to ensure all applicable taxes are accounted for.

- Once all fields have been filled out accurately, review the entire form to confirm that all information is correct and complete.

- Save changes to your document, and then you have the option to download, print, or share the completed form as necessary.

Complete your State Form 43760 online today to ensure your business is properly registered and compliant.

You may also need to set up e-file and e-pay for your new state. Select Employees, then Payroll Taxes and Liabilities, and select Edit Payment Due Dates. Select Schedule payments. Select your new state tax, then select Edit. From the Payment (deposit) method, select E-pay. Select your Payment (deposit) frequency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.