Loading

Get City Of Evans Sales And Use Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CITY OF EVANS SALES AND USE TAX RETURN online

Filing the City of Evans sales and use tax return online can be straightforward and efficient. This guide offers a step-by-step approach to help users easily navigate through the process and ensure all necessary information is accurately submitted.

Follow the steps to successfully complete the tax return form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

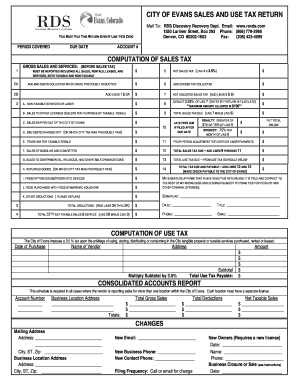

- Identify the period covered and the due date for this tax return. Fill in your account number as required.

- In the computation of sales tax section, report your gross sales and services before tax in line 1, including all sales, rentals, leases, and services, both taxable and non-taxable.

- Add any bad debts collected that were previously deducted in line 2A. Ensure to enter the total of lines 1 and 2A in line 3.

- Proceed to calculate your net sales tax by entering the value in line 5 and adding any excess tax collected in line 6.

- In line 7, determine your net adjusted sales tax by adding the values from lines 5 and 6.

- Deduct non-taxable services or labor as specified in line 8, and make sure to include only certain allowable deductions.

- Complete lines 9 through 13, ensuring to report any other applicable deductions, such as sales shipped out of the city, bad debts, and any penalties if filed after the due date.

- Review the computation of use tax section by listing any purchases made, the vendors, and calculating the applicable use tax.

- In the consolidated accounts report, compile totals for all business locations if applicable, ensuring to provide the necessary account numbers and sales figures.

- Finally, complete the changes section if any updates are needed for mailing or business information, and ensure to provide your signature, date, title, phone, and email where indicated.

- After completing the form, save your changes, and proceed to download, print, or share the completed tax return as needed.

Complete your tax return online to ensure compliance and timely filing.

The state consumer use tax rate is the same as the sales tax rate: 2.9%. With proof of payment, sales tax paid to another state may be credited against consumer use tax due in Colorado for a particular item. Use tax is also collected by some local governments and special districts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.