Loading

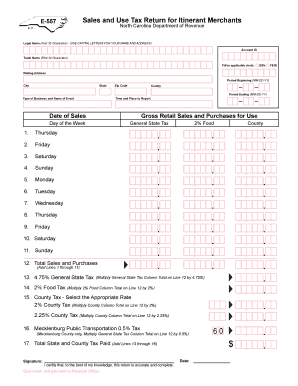

Get Form E-557 - Nc Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form E-557 - NC Department Of Revenue online

Filling out the Form E-557 is essential for reporting sales and use tax for itinerant merchants in North Carolina. This guide provides a step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to complete your tax return correctly.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your legal name in capital letters in the provided field. Ensure it fits within the first 32 characters.

- Input your Account ID, which is required for processing your tax return.

- Fill in the trade name in capital letters, confined to the first 32 characters.

- Select the applicable circle next to your Social Security Number (SSN) if applicable.

- Provide your mailing address, including the city, state, and zip code.

- Specify the county in which you are conducting business.

- Indicate the period for which you are reporting, entering both the beginning and ending dates in MM-DD-YY format.

- Detail the type of business and the name of the event associated with your sales.

- Fill in the time and place where you will report your sales.

- Record the date of sales for each day of the week listed.

- Provide gross retail sales and purchases for use, entering totals for each day of the week in the designated fields.

- Complete the General State Tax section by multiplying the total sales (from line 12) by 4.75%.

- Fill in the Food Tax section by calculating 2% of the total sales (from line 12).

- Choose the appropriate county tax rate (2% or 2.25%) and calculate based on the county column total.

- If reporting for Mecklenburg County, include the Public Transportation Tax of 0.5% in your calculations.

- Add all tax lines together to find the Total State and County Tax Paid.

- Sign the form, certifying that the information is accurate and complete, and include the date.

- Review your entries for accuracy, then save changes, download, print, or share the form as needed.

Complete your Form E-557 online today to ensure timely reporting of your sales and use tax.

Where can I get more information? Review this information on collecting past due taxes, or call 1-877-252-3252 (toll-free) if the taxpayer has additional questions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.