Get Gst34 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst34 3 online

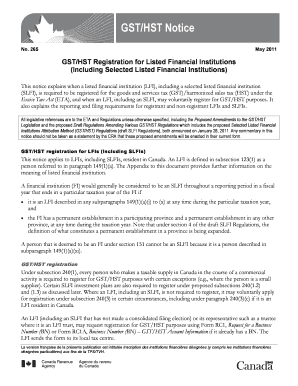

Filling out the Gst34 3 online is a crucial step for listed financial institutions to ensure compliance with goods and services tax/harmonized sales tax reporting requirements. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete your Gst34 3 online

- Press the ‘Get Form’ button to obtain the Gst34 3 form and open it in your preferred online editor.

- Review the form for any specific requirements related to your financial institution's status and activities.

- Fill in the appropriate identification information, including your business number and the name of your financial institution.

- Complete the sections regarding your taxation period and any other details relating to goods and services provided.

- Double-check all entries for accuracy to minimize the risk of errors in your submission.

- Save your completed Gst34 3 form, and consider downloading or printing a copy for your records before submission.

- Finally, submit the form according to the required online procedures to ensure efficient processing.

Start completing your Gst34 3 online today to ensure timely compliance with tax regulations.

Filing GST involves a few simple steps. First, gather all necessary documents, including invoices and receipts. Next, access the GST portal and log in using your credentials. After that, select the appropriate form, such as GSTR-3B, and fill in the required details accurately before submitting your return. The Gst34 3 resource can assist you in navigating this process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.