Loading

Get Form Dtf-950:9/11: Certificate Of Sales Tax Exemption For Diplomatic ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DTF-950:9/11: Certificate of Sales Tax Exemption for Diplomatic Entities online

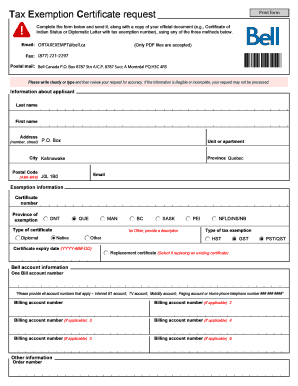

Filling out the Form DTF-950:9/11 is an important step for individuals or organizations seeking sales tax exemptions related to diplomatic activities. This guide provides clear instructions to help users complete the form efficiently and effectively online.

Follow the steps to complete the form accurately and securely.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the 'Information about applicant' section, provide your last name and first name. Fill in your complete address, including the street number and name, P.O. Box (if applicable), unit or apartment number, and city. Ensure the city is entered as Kahnawake, along with your province as Quebec and the corresponding postal code (J0L 1B0).

- Next, move to the 'Exemption information' section. Fill in the certificate number assigned to you and select the province of exemption. Choose the type of certificate, indicating whether you are a diplomat, native, or if another category applies, provide a description.

- Indicate the expiry date of the certificate in the format YYYY-MM-DD. Select the type of tax exemption applicable, which could be HST, GST, or PST/QST.

- If you are replacing an existing certificate, select this option to ensure your request is correctly processed.

- Fill in your Bell account information accurately. Provide all relevant account numbers, including Internet, TV, Mobility, Paging, or Home Phone numbers where applicable.

- Include any additional details required, such as the order number if relevant.

- Review all the information you have entered to ensure accuracy and legibility. Incomplete or illegible forms may be rejected.

- Once completed, save any changes made to the form, and download or print it for your records.

- Finally, submit the form either by email (only PDF files accepted), fax, or postal mail as per the provided instructions.

Complete your forms confidently and explore more documents to manage your requirements online.

When you file exempt with your employer, however, this means that you will not make any tax payments whatsoever throughout the tax year. Therefore, you will not qualify for a tax refund unless you are issued a refundable tax credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.