Loading

Get Bers Tda

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bers Tda online

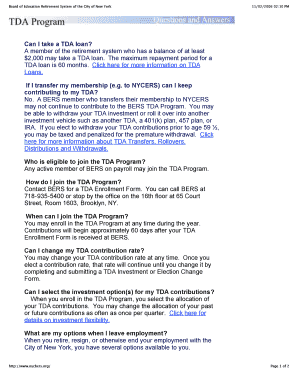

Filling out the Bers Tda form online is an essential step for members of the retirement system. This guide provides clear instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the Bers Tda form online.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Read the instructions provided on the form carefully. Make sure you understand each section before proceeding.

- Enter your personal information accurately. This includes your name, address, and contact details as required in the designated fields.

- If applicable, select your TDA contribution rate and investment options. Ensure you are aware of your choices as they can impact your retirement savings.

- Review your entries to confirm they are correct. It is important that all information is complete and accurate to avoid processing delays.

- Once you have verified all information, save your changes. You can choose to download, print, or share the completed form as needed.

Start filling out your Bers Tda form online today for a seamless retirement planning experience.

If you want to opt out of the Bers NYC DOE, you typically need to follow specific procedures outlined by your employer. It’s advisable to consult your HR department or the plan administrator for the exact steps. Some employees may not realize that an opt-out can impact your retirement savings with a Bers TDA. Always weigh the long-term effects before making a decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.