Loading

Get Form 910

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 910 online

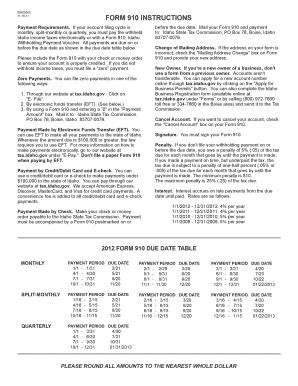

Filling out Form 910 online can streamline your tax payment process. This guide provides step-by-step instructions to help you complete the form efficiently and accurately.

Follow the steps to fill out Form 910 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Input your correct mailing address in the designated section. If you need to update an incorrect address, check the 'Mailing Address Change' box and enter the new details.

- In the 'Payment Amount' box, enter the amount of Idaho income tax that has been withheld from employee wages during the payment period. Ensure to round the amount to the nearest whole dollar.

- If you are filing a zero payment, enter '0' in the 'Payment Amount' box to indicate no taxes were withheld.

- Check the 'Cancel Account' box if you wish to cancel your account with the Idaho State Tax Commission.

- Confirm your submission by reviewing all entered data for accuracy before saving.

- Once completed, save your changes. You can then download, print, or share the form as necessary.

Start filling out your Form 910 online today to ensure timely submission.

Idaho (ID) State Payroll Taxes for 2023 The State of Idaho is on the higher end of marginal income tax rates compared to the rest of the country. It's a progressive income tax in seven brackets that range from 1.125% to 6.925%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.