Loading

Get Non-resident Refund Request Form - Springboro, Ohio

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non-Resident Refund Request Form - Springboro, Ohio online

Filling out the Non-Resident Refund Request Form for Springboro, Ohio is a straightforward process that allows individuals to claim a refund of city income tax withheld in excess of their liability. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete your refund request form successfully.

- Click ‘Get Form’ button to obtain the Non-Resident Refund Request Form and open it in your editor.

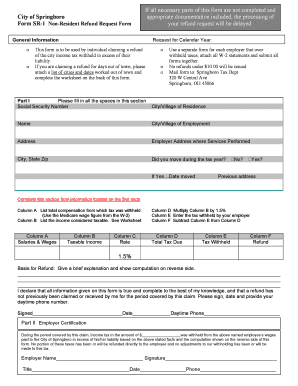

- In Part I, fill in all required fields, including your social security number, name, address, and the city/village of residence and employment. If you moved during the tax year, indicate the date of your move.

- Complete the compensation and tax details. Reference your W-2 to fill in Column A with total compensation, Column B with taxable income (as calculated), Column E with tax withheld by your employer, and calculate Column D and Column F as instructed.

- In the Basis for Refund section, provide a brief explanation and computations, ensuring clarity and specificity in your claim.

- Sign and date the form in the designated area, and include your daytime phone number for any follow-up inquiries.

- Part II requires employer certification. Ensure an authorized person from your employer completes this section, providing their name, title, signature, date, and phone number.

- Attach any necessary documentation, including W-2 forms and a list of cities and dates worked outside of Springboro if applicable.

- Review the entire form for completeness. Incomplete submissions will lead to delays.

- Once all sections are complete and reviewed, save your changes, and choose to download, print, or share the form as needed.

Begin filing your Non-Resident Refund Request Form online today to ensure you receive any eligible refunds!

Cities that administer their own taxes on their own form: City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.