Get Mississippi Summary Of Net Income Of Corporations Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mississippi Summary of Net Income of Corporations Form online

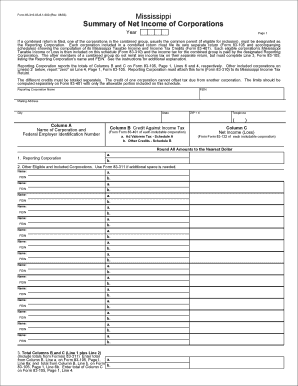

Completing the Mississippi Summary of Net Income of Corporations Form is essential for corporations submitting their income tax returns. This guide provides a user-friendly overview of the form's components and offers step-by-step instructions to help you complete it online.

Follow the steps to effectively complete the form

- Click ‘Get Form’ button to access the form and open it in your document editor.

- Enter the reporting corporation's name and Federal Employer Identification Number (FEIN) in the designated fields at the top of the form.

- Fill in the mailing address, city, state, and ZIP + 4 code for the reporting corporation as requested.

- List the names and FEINs of other eligible and included corporations under Column A. For each corporation, complete Column B by entering the credits against income tax and Column C by noting the net income or loss from the applicable forms.

- If you have more corporations to list than available space, indicate this by using Form 83-311.

- Calculate and enter the total amounts for Columns B and C. The total from Line 1 and Line 2 of Column B should be recorded accordingly, as well as the total of Column C. This information will be transferred to specific lines on Form 83-105.

- Review all entries for accuracy and completeness, ensuring all amounts are rounded to the nearest dollar.

- Once all fields are filled out, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your form online today to ensure timely submission.

S Corporations generally report their income using Form 1120S at the federal level. In Mississippi, S Corps should utilize the Mississippi Summary Of Net Income Of Corporations Form to fulfill their state tax responsibilities. This form helps S Corps report not just income but also any deductions or credits they may be eligible for. Always ensure you're following the latest guidelines to stay compliant with both federal and state tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.