Get Application For Texas Agriculture Exemption Form Ap 228

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Texas Agriculture Exemption Form Ap 228 online

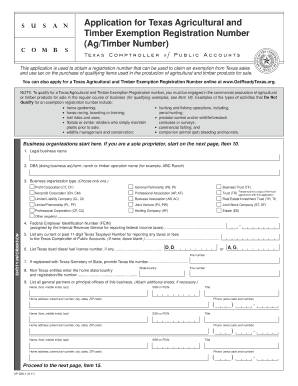

The Application For Texas Agriculture Exemption Form Ap 228 is essential for individuals and businesses engaged in the production of agricultural and timber products. This guide provides comprehensive, step-by-step instructions to help users fill out the form online accurately and efficiently.

Follow the steps to complete the application form online

- Click 'Get Form' button to access the application and open it in your preferred editor.

- Fill in the legal business name in the first section of the form. Ensure the name matches the records held by the Texas Secretary of State.

- Provide the DBA (doing business as) or the name of your farm, ranch, or timber operation. For example, 'ABC Ranch'.

- Select your business organization type from the provided list, ensuring to choose only one that accurately describes your business.

- Enter your Federal Employer Identification Number (FEIN), if applicable, which is assigned by the Internal Revenue Service for federal tax reporting.

- List any current or past Texas Taxpayer Number for tax reporting purposes, leaving the field blank if none applies.

- If you are a Texas entity, provide your Texas file number as registered with the Texas Secretary of State.

- For non-Texas entities, input your home state or country and any associated registration or file number.

- List all general partners or principal officers in your business, providing their names, titles, and contact information as required.

- If you are a sole proprietor, start filling in your details in the sole proprietor section, beginning with your name.

- Provide either your FEIN, Social Security Number (SSN), or other identification as specified in this section.

- Complete your mailing address, ensuring all details are accurate, including city, state, and ZIP code.

- Identify the contact person for business records and fill out their information.

- Specify your business's primary physical location where agricultural or timber products are grown or raised.

- Indicate the principal type of exempt activity by selecting the appropriate option from the list provided.

- All necessary parties must sign the application, certifying their engagement in agricultural production and acknowledging tax obligations.

- Submit the completed form either in person at local offices or by mailing it to the listed address. Ensure you keep a copy for your records.

Complete your Texas Agriculture Exemption application online today to ensure compliance and benefit from available tax exemptions.

The 3-year rollback tax in Texas refers to a penalty incurred if a property that was eligible for agricultural exemption is changed to a non-agricultural use. This tax recaptures the difference between the agricultural and market value for the last three years. Filing the Application For Texas Agriculture Exemption Form Ap 228 is crucial to avoid future penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.