Loading

Get Form 322-era - Indy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 322-ERA - Indy online

Filling out Form 322-ERA - Indy online is a straightforward process that helps property owners apply for deductions from assessed valuations in economic revitalization areas. This guide provides step-by-step instructions to ensure a smooth experience.

Follow the steps to fill out Form 322-ERA - Indy effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

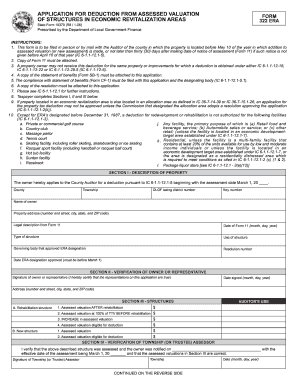

- In Section I, provide a description of the property. Enter the county, township, DLGF taxing district number, key number, name of owner, property address, legal description from Form 11, date of Form 11, type of structure, use of structure, governing body that approved ERA designation, resolution number, and the date the ERA designation was approved.

- Proceed to Section II, where either the owner or their representative must sign, certifying that the information provided is true. Include the date signed and the address of the signatory.

- In Section III, indicate the type of structure (rehabilitation or new). Complete the assessed valuation details, including valuations before and after rehabilitation, and calculate the increase in assessed valuation.

- Section IV requires the verification from the township or trustee assessor. This section is to be filled out and signed by the assessor, confirming that the details and valuations provided in Section III are correct.

- Section V focuses on the deductions available. Fill out the percentages and amounts of deductions corresponding to the duration of the deduction period.

- If applicable, Section VI pertains to areas defined as residentially distressed. Enter the assessed values and deductions for one to four family dwellings as required.

- Lastly, if the application is approved, Section VII must be signed by the county auditor, indicating the approval along with the date signed.

- Once all sections are completed, save any changes to the form. You can download, print, or share the completed form as needed.

Start filling out your Form 322-ERA - Indy online to apply for your property deduction today.

Related links form

The vacant building abatement is limited to buildings that are zoned for commercial or industrial purposes only. Taxes owed on the building can be abated for either one or two years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.