Get Form 8689

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8689 online

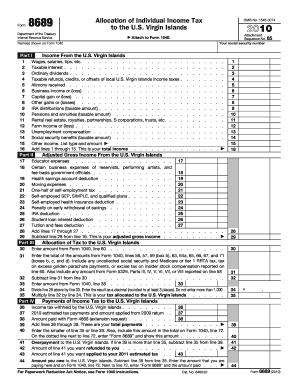

Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands, is essential for taxpayers who owe tax to the U.S. Virgin Islands based on their income. This guide provides a clear and supportive framework for filling out this form online, ensuring you understand each section and field.

Follow the steps to successfully complete Form 8689 online.

- Click the ‘Get Form’ button to access the form online and open it in your preferred digital editor.

- Begin by entering your social security number and the names as shown on Form 1040 at the top of the form. This is crucial for proper identification and processing of your submission.

- In Part I, document your income from the U.S. Virgin Islands. Fill in the relevant amounts for each category, including wages, interest, dividends, alimony, and any other income sources listed from lines 1 to 15.

- Proceed to Part II to calculate your adjusted gross income. Complete lines 17 through 28 by providing all relevant adjustments to your income based on your U.S. Virgin Islands earnings.

- In Part III, calculate the allocation of your tax to the U.S. Virgin Islands. Follow the instructions for lines 30 to 35, ensuring accurate multiplication and division for correct tax allocation.

- Move to Part IV and fill in your payments of income tax to the U.S. Virgin Islands. Report the amounts from various sources as indicated on lines 36 to 44, summarizing your total payments.

- Once all sections are completed, save your changes. You may then download, print, or share the filled Form 8689 as required.

Complete your Form 8689 online efficiently and ensure accurate tax reporting.

IRS Form 8606 is primarily used to report nondeductible contributions to traditional IRAs, and it also covers distributions from Roth IRAs. This form ensures proper documentation of contributions and distributions, safeguarding taxpayers from future tax liabilities. Although it may not directly relate to Form 8689, understanding IRS Form 8606 can aid in your overall tax planning strategy. By being informed about various forms, you ensure accurate and efficient tax filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.