Loading

Get Hi Dot U-6 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT U-6 online

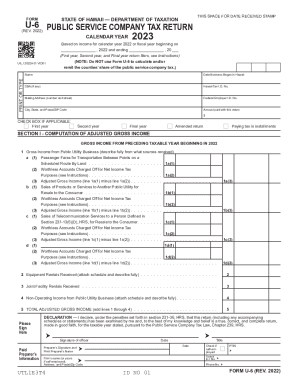

Filling out the HI DoT U-6 form is essential for public service companies operating in Hawaii. This guide provides a detailed walkthrough of each section of the form, ensuring a smooth and accurate submission process.

Follow the steps to complete the HI DoT U-6 form online.

- Press the ‘Get Form’ button to access the HI DoT U-6 document and open it for editing.

- Begin by entering the calendar year for which the tax is being reported. This typically includes the year you are filing for, such as 2022.

- Fill in your name, the date your business began in Hawaii, any doing business as (DBA) names, and your Hawaii Tax ID number in the designated fields.

- Provide your mailing address, including the street address, city, state, and postal/ZIP code.

- Input your Federal Employer ID number and the amount paid with this return, denoting any applicable checkboxes for first year, second year, final year, amended return, or paying tax in installments.

- Move to Section I and begin computing adjusted gross income. Detail your gross income from the prior taxable year and adjust for any worthless accounts as indicated.

- Calculate total adjusted gross income by adding all applicable lines under Section I.

- In Section II, compute the tax based on the adjusted gross income. Follow the specific multipliers for each component listed, including public utility rates.

- Be sure to check for any nonrefundable tax credits and subtract them accordingly from your total tax owed.

- Review your completed form for accuracy, then save the changes, and choose to download, print, or share the completed HI DoT U-6 form.

Submit your HI DoT U-6 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.