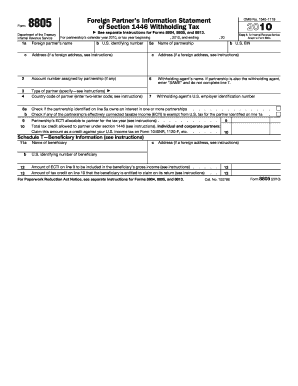

Get 2010 Form 8805

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8805 online

Filling out the 2010 Form 8805 accurately is essential for reporting the foreign partner's information regarding Section 1446 withholding tax. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth and compliant process.

Follow the steps to complete the 2010 Form 8805 online

- Click the ‘Get Form’ button to access the 2010 Form 8805 and open it in your chosen editing tool.

- In section 1, enter the foreign partner's name and their U.S. identifying number.

- Provide the address for the foreign partner. If the partner has a foreign address, be sure to consult the specific instructions for guidance.

- In section 5, fill in the name of the partnership and its address, applying the same guidance for foreign addresses.

- Complete the account number assigned by the partnership, if applicable.

- Indicate the type of partner in section 4; specify the relevant category as highlighted in the instructions.

- Input the country code for the partner using the two-letter code as indicated.

- For withholding agent's information, fill in their U.S. employer identification number in section 7.

- Review section 8 and mark if the partnership owns an interest in additional partnerships.

- Check if any of the partnership's effectively connected taxable income is exempt from U.S. tax for the specified partner.

- In section 9, detail the partnership's effectively connected taxable income applicable to the partner for the tax year.

- In section 10, record the total tax credit the partner is eligible to claim under section 1446.

- If applicable, complete the Schedule T for beneficiary information, including names and relevant U.S. identifying numbers.

- Once all fields are completed, review your entries for accuracy. Save your changes, and then proceed to download, print, or share the completed form as needed.

Complete your forms online today for an efficient filing process.

To fill out the AW 8BEN form correctly, start by providing your personal information, including your name and address. Next, include your taxpayer identification number and any relevant details that apply to the 2010 Form 8805 if needed. Accuracy is key, so ensure that all information is correct before submission. For additional help with the process, consider using the tools and resources available on USLegalForms, which can simplify filling out any tax-related documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.