Loading

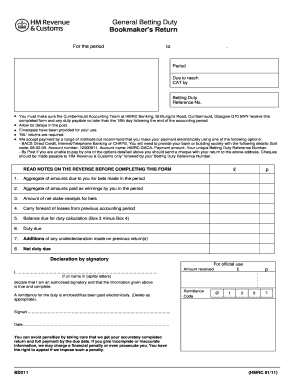

Get Bd211 - General Betting Duty Bookmakers Return. You Use This Form To Submit Your Bookmakers Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the BD211 - General Betting Duty Bookmakers Return. You Use This Form To Submit Your Bookmakers Return online

This guide provides a comprehensive overview of how to effectively complete the BD211 - General Betting Duty Bookmakers Return online. It offers step-by-step instructions tailored to assist users of all experience levels in accurately submitting their bookmakers return.

Follow the steps to fill out the BD211 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the field labeled 'For the period,' enter the accounting period dates relevant to your return, formatted as dd/mm/yyyy. For example, you might enter 01/12/2022 to 31/12/2022.

- Provide your business name, any trading name, and the complete business address along with the postal code in the designated section for 'Name and address'.

- In the 'Period' section, indicate the accounting period in the format mm/yyyy (e.g., 12/2022).

- Fill in the 'Due to reach CAT by' field with the date of the 15th day following the end of your accounting period. Ensure this date aligns with the submission requirements.

- Insert your unique Betting Duty Reference Number in the 'Betting Duty Reference No' box, ensuring it is a nine-digit number (e.g., 123456789).

- Complete Box 1 by listing the aggregate value of all bets made with you during the accounting period, including free bets and hedged bets.

- In Box 2, enter the total value of winnings paid by you in the same accounting period, including amounts processed for credit customers.

- In Box 3, calculate and display the net stake receipts by subtracting the value in Box 2 from Box 1.

- If applicable, indicate any losses carried forward from the previous accounting period in Box 4.

- In Box 5, show the balance due for duty calculation by subtracting the value in Box 4 from Box 3.

- Calculate the duty due for the accounting period and enter this value in Box 6.

- If you have any underpayments from previous returns, include this in Box 7.

- Finalize Box 8 with the net duty due, which should equal Box 6 unless there are underpayments in Box 7.

- Sign the declaration by writing your full name and provide the date of completion before submitting your return.

- Once all sections are completed, you can save changes, download, print, or share the form as necessary.

Complete your BD211 - General Betting Duty Bookmakers Return online today to ensure timely submission.

Betting Intermediary Duty is an excise duty charged on commissions charged by Licensed Remote Betting Intermediaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.