Get Relief Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Relief Form online

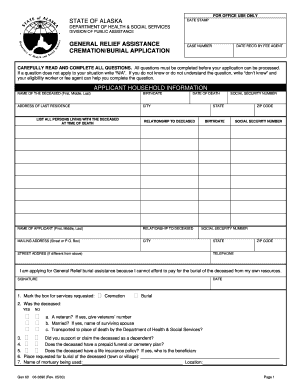

Filling out the Relief Form online can be a straightforward process when approached step by step. This guide will provide you with clear instructions on how to complete each section of the form to ensure it is processed efficiently.

Follow the steps to successfully complete the Relief Form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by providing applicant household information. This includes the name of the deceased, their birthdate, address of last residence, and date of death. Fill in all fields, and if a question does not apply, write 'N/A'. If uncertain, write 'don’t know'.

- Complete the relationship section by indicating your relationship to the deceased and providing your own name and social security number.

- In the services requested section, mark the box for either cremation or burial based on your needs.

- Answer the questions regarding the deceased, including veteran status and marital status, and provide additional details where applicable.

- Fill in the income and resources section accurately. List all non-work income sources and employment information for each person living with the deceased. Include details such as employer’s phone number and payment amounts.

- Certify that the information you provided is complete and accurate in the agreement section. Your signature is required, along with the date of signing.

- Finally, review your form carefully for any errors, save your changes, and download, print, or share the completed form as needed.

Complete your Relief Form online today to ensure timely assistance.

To file for innocent spouse relief, you must complete Form 8857, which is the official request for this type of relief. In the form, explain your situation and provide documentation showing how your spouse's actions have negatively impacted you. The relief form is crucial in proving your case for innocence and qualifications for relief. Accurate and complete submission will help expedite the process, allowing you to gain the protection you seek under the tax law.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.