Loading

Get Form 12a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12a online

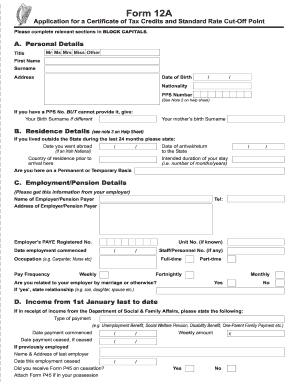

Filling out Form 12a online is a straightforward process designed to assist individuals in applying for their Certificate of Tax Credits and standard rate cut-off point. This guide provides step-by-step instructions to ensure you provide the necessary information accurately and efficiently.

Follow the steps to complete Form 12a online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Section A, Personal Details. Complete each field in BLOCK CAPITALS. Input your title, first name, surname, address, date of birth, nationality, and PPS number. If you do not have a PPS number, provide your birth surname if it is different.

- Move on to Section B, Residence Details. Here, indicate your mother’s birth surname, and if you have lived outside the State in the last 24 months, provide the relevant dates and country of residence, along with the intended duration of your stay and your residency status (permanent or temporary).

- In Section C, Employment/Pension Details, gather information from your employer. Input the name, address, telephone number of your employer or pension payer, and the employer’s PAYE registered number. Include your date of employment commencement, staff number if available, occupation, pay frequency, and whether you are related to your employer.

- In Section D, record your income from January 1st to the present date. If receiving income from the Department of Social & Family Affairs, provide the type of payment, payment dates, weekly amount, and details of prior employment if applicable, including whether you have received a Form P45.

- Proceed to Section E to detail any other income sources. List the description of the income and the annual amount for yourself and your partner if applicable.

- In Section F, Claim for Tax Credits & Reliefs, select the relevant tax credits you wish to claim by ticking the appropriate boxes. Some credits may require additional information.

- Section G collects information about your spouse, if applicable. Provide the necessary details including their income, employer information, and any relevant dates regarding separation or divorce.

- Finally, complete the declaration section by signing and dating the form. Ensure to provide a daytime telephone number for any potential follow-up.

- Save your changes, and choose to download, print, or share the completed form as needed. Be sure to send it to your Regional Revenue Office as soon as possible.

Start filling out your Form 12a online today to ensure timely processing of your tax credits.

The process of 12A registration involves submitting an application that details the organization’s objectives, funding sources, and compliance with the Income Tax Act. It typically requires careful completion of Form 12a, along with supporting documents. Following all required steps precisely increases the likelihood of receiving tax-exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.