Loading

Get Form Ct-1120 Jet - Ct.gov - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form CT-1120 JET - CT.gov - Ct online

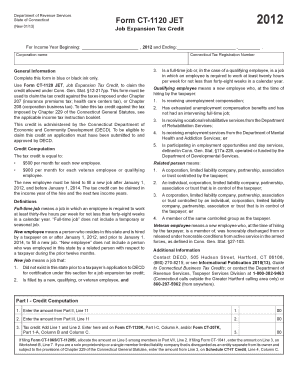

This guide provides a clear and supportive overview for users on how to accurately fill out the Form CT-1120 JET, which is essential for claiming the Job Expansion Tax Credit in Connecticut. Follow these steps to ensure you complete the form correctly and efficiently.

Follow the steps to successfully complete the Form CT-1120 JET.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by filling in the corporation name at the top of the form. Ensure that you complete this section accurately as it identifies the entity applying for the tax credit.

- Indicate the income year for which you are claiming the credit by entering the starting and ending dates in the specified fields.

- Complete the Connecticut tax registration number section with the appropriate registration details to properly associate the tax credit with your corporation.

- In Part I, calculate the tax credit amount. Enter the amounts from Part II and Part III as required, then sum these totals and enter them in the provided line.

- In Part II, list each qualifying or veteran employee. For each employee, fill in their name, Social Security number, and check if they are a resident of Connecticut. Also, provide the date of hire.

- Continue entering data for each qualifying or veteran employee as needed, ensuring you have the correct information for each entry.

- In Part III, if applicable, repeat the process for any other new employees, using the same fields to record their information.

- Once all sections are completed and all necessary calculations are made, review the form for accuracy.

- Finally, save your changes, download the completed form, print it, or share it as needed.

Complete your Form CT-1120 JET online today to take advantage of the Job Expansion Tax Credit!

Form 1120-C If the corporation's principal business, office, or agency is located in:Use the following IRS center address:The United StatesDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-0012A foreign country or U.S. possessionInternal Revenue Service PO Box 409101 Ogden, UT 84409 Dec 9, 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.