Loading

Get Bta Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bta Form online

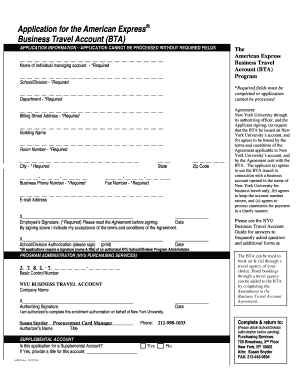

This guide provides you with clear, step-by-step instructions on filling out the Bta Form for the American Express Business Travel Account online. Ensuring all required fields are completed correctly will help facilitate a smooth application process.

Follow the steps to complete the Bta Form online.

- Press the ‘Get Form’ button to access the Bta Form and open it for editing.

- Fill in the name of the individual managing the account in the designated field, remembering that this field is required.

- Indicate the school or division associated with the account in the provided section, as this is also a required entry.

- Complete the department field, ensuring it is filled out completely.

- Enter the billing street address; this is mandatory for processing the application.

- If applicable, provide the building name associated with the account.

- Fill out the room number; this information is required.

- Input the city, ensuring it matches the billing address.

- Select the appropriate state from the dropdown list to reflect the billing address.

- Enter the zip code corresponding to the billing street address.

- Provide the business phone number, ensuring it is accurate for contact purposes.

- Optionally, you may include a fax number as an alternative communication method.

- Enter a valid email address for correspondence related to the application.

- Have the employee managing the account sign in the signature field, acknowledging acceptance of the terms and conditions.

- Enter the date of the signature to indicate when the form was signed.

- If applicable, have the authorizing officer from the school or division sign the designated section.

- Ensure all signatures and authorizations are obtained, then save the form.

- After completing the form, you may download, print, or share it as necessary.

Complete your Bta Form online today to facilitate your business travel arrangements.

In order to file an appeal, you must submit a “Notice of Appeal or Objection” form and three (3) copies to the Board of Tax Appeals and one (1) copy to the Mississippi Department of Revenue. Click on the link below to access this fillable form. Detailed instructions for submission are on the top of the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.