Loading

Get Form 569

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 569 online

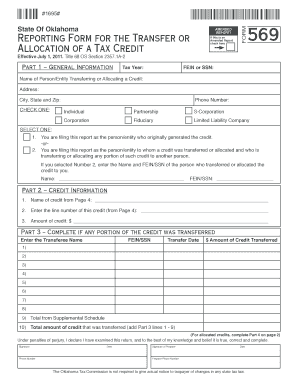

Filling out the Form 569 is a crucial step for reporting the transfer or allocation of tax credits in Oklahoma. This guide provides clear and detailed instructions to assist users in completing the form online with confidence.

Follow the steps to successfully complete the Form 569 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor for online completion.

- In Part 1, enter the tax year in which the credit was generated or transferred. Provide your FEIN or SSN, along with the name and address of the person or entity transferring the credit. Select the appropriate option indicating whether you generated the credit or received it.

- Proceed to Part 2. Enter the name of the credit from the list on Page 4, the corresponding line number, and the total amount of the credit.

- In Part 3, if you have transferred any portion of the credit, list the names and FEIN/SSN for each transferee, along with the date of transfer and the amount of credit transferred.

- If applicable, complete Part 4 by listing the name of each shareholder, partner, or member who received an allocated credit, their FEIN/SSN, and whether each is a pass-through entity. Total the amounts allocated.

- Review all sections to ensure accuracy. Once completed, save your changes, and you are able to download, print, or share the form as needed.

Ensure your tax credits are correctly reported by filling out the Form 569 online today!

Simply call (405) 521-3160 or in-state toll free (800) 522-8165, extension 13160 and select the option to "Check the status of an income tax refund". By providing your Social Security Number and amount of your refund, the system will provide you with the status of your Oklahome tax refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.