Get Form 741 Kentucky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 741 Kentucky online

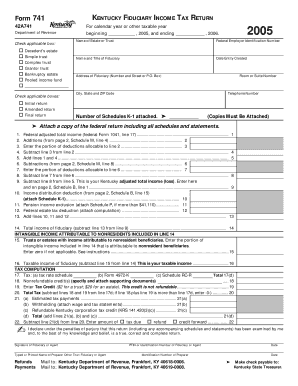

Filling out the Form 741 for Kentucky fiduciary income tax can be a straightforward process if approached step by step. This guide will provide you with instructions to complete this form online, ensuring you accurately report the necessary information.

Follow the steps to accurately complete the Form 741 online.

- Press the ‘Get Form’ button to access the Form 741, allowing you to fill out the document directly in your preferred editor.

- Begin by entering the name of the estate or trust and the Federal Employer Identification Number in the designated fields.

- Indicate the type of entity (decedent's estate, simple trust, complex trust, etc.) and provide the name and title of the fiduciary.

- Fill in the date the entity was created and the address of the fiduciary, including the room or suite number, city, state, and ZIP code.

- Check the boxes to indicate whether this is an initial, amended, or final return.

- Provide the telephone number for the fiduciary and the number of Schedules K-1 attached, making sure to include copies as required.

- Complete the income fields by transferring federal adjusted total income and relevant addition and subtraction items, following instructions for each line.

- Calculate and report taxable income according to the computations outlined on the form, ensuring to include any attachments needed.

- Review the tax computation section and enter applicable tax credits, estimated payments, and withholding amounts.

- Finally, have the fiduciary or agent sign the form. Input the printed name, identification number, and date.

- After finalizing your entries, you can save changes, download, print, or share the completed form as needed.

Complete your Form 741 Kentucky online and ensure your fiduciary income tax is accurately filed.

To claim your withholding exemption, you need to fill out the Kentucky state withholding form accurately and submit it to your employer. This form will indicate your eligibility for exemption based on your income and filing status. If you're dealing with fiduciary matters, be sure to refer to Form 741 Kentucky for any additional requirements. Following these steps will help ensure you properly claim your exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.