Loading

Get Ca Ftb 3563 For 2013 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca Ftb 3563 For 2013 Form online

Filling out the Ca Ftb 3563 For 2013 Form online is a straightforward process that can help fiduciaries secure an automatic extension for tax filings. This guide will walk you through each section of the form, ensuring you provide all necessary information accurately.

Follow the steps to complete the form effectively.

- Use the ‘Get Form’ button to access the Ca Ftb 3563 For 2013 Form. This will allow you to open the form in an online editing platform.

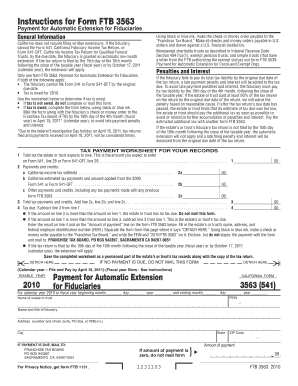

- Fill in the taxable year at the top of the form, indicating whether it is for the calendar year or fiscal year. Ensure to provide the correct beginning and ending months and days.

- Provide the federal employer identification number (FEIN) for the estate or trust in the designated field.

- Enter the name of the estate or trust in the corresponding field, along with the name and title of the fiduciary responsible.

- Complete the address section, including the street number, suite, city, state, and ZIP code.

- Review line 1 of the tax payment worksheet. Enter the total tax expected to be owed, which aligns with Form 541 or Form 541-QFT.

- On line 2, record any payments and credits applicable, including California income tax withheld and other payments relevant from previous forms.

- Calculate the total tax payments and credits on line 3 by summing the values from line 2.

- Determine the tax due on line 4 by subtracting line 3 from line 1. If line 1 is greater, enter the amount due.

- If payment is due, make a check or money order payable to the ‘Franchise Tax Board,’ and include the FEIN and ‘2010 FTB 3563’ in the memo.

- Attach the payment with the form and mail it to the address provided, ensuring it is sent before the due date to avoid penalties.

- Once all fields are filled in, you can save your changes, download a copy for your records, or print the completed form.

Begin filling out the Ca Ftb 3563 For 2013 Form online today to ensure your tax filing is completed on time.

How do I pay the annual franchise tax? Go to .ftb.ca.gov/pay. Choose “Bank Account” Choose Web Pay Business or Web Pay Personal, depending on the entity type. Follow the prompts to provide the requested information and pay the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.