Get Multi Purpose Loan Mpl Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Multi Purpose Loan Mpl Application Form online

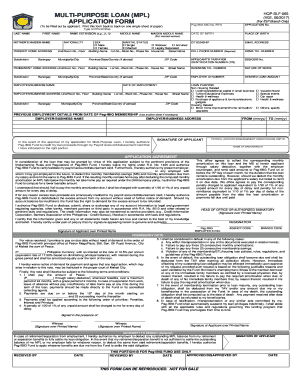

Filling out the Multi Purpose Loan (MPL) application form online is a straightforward process that allows users to efficiently apply for financial assistance. This guide walks you through the different sections of the form, providing clear instructions to ensure that you complete it accurately.

Follow the steps to fill out your application accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Pag-IBIG MID Number and Application Number. Ensure these are correct as they are vital for your application.

- Fill out your personal details including your date of birth, place of birth, citizenship, email address, and contact numbers. Accurate contact information is essential for communication regarding your application.

- Provide your Taxpayer Identification Number (TIN), SSS/GSIS number, and business telephone number, if applicable.

- Indicate your nature of work and employee ID number if you are employed.

- In the Desired Loan Amount field, specify the amount you are seeking based on your financial needs.

- Complete your name details by typing or printing your last name, first name, name extension (if applicable), middle name, maiden middle name (for married applicants), and your mother’s maiden name.

- Enter your present home address, including unit/room number, building name, street name, municipality/city, province/state, country (if applicable), and barangay.

- Fill out your permanent home address with the same details as above, ensuring all information is consistent.

- Provide your employer's business name, address, date of employment, and employer number if available.

- Choose the loan purpose by checking the appropriate box, and if any special purposes apply, specify them in the provided area.

- If you have previous employment details since joining Pag-IBIG, include them as required.

- At the bottom of the form, review the application agreement and sign, authorizing Pag-IBIG Fund to process your application. Include your bank information for the loan proceeds if applicable.

- Review the completed form for any errors or omissions before submission.

- Save your changes, download a copy for your records, and prepare to print or share the form as needed.

Get started on filling out your Multi Purpose Loan application form online today!

In finance, MPL refers to a Multi Purpose Loan, which is a versatile funding option designed to meet various financial needs. This type of loan allows you to finance personal projects, home improvements, or business ventures. Completing the Multi Purpose Loan Mpl Application Form is essential to access these benefits. It simplifies your application, making it easier to secure the funds you need.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.