Get 2015 Ar4 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

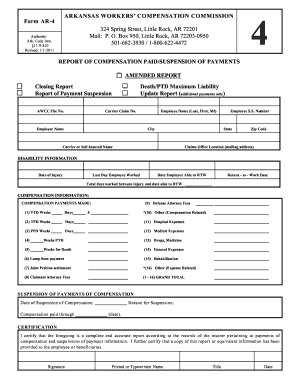

How to fill out the 2015 AR4 Fillable Form online

Filling out the 2015 AR4 Fillable Form online can seem daunting, but with clear instructions, you can navigate this process with ease. This guide provides step-by-step assistance to ensure that your form is completed accurately and efficiently.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the 2015 AR4 Fillable Form and open it in your browser.

- Begin by entering the AWCC file number, which is crucial for tracking your submission. This is found at the top section of the form.

- Provide the carrier claim number, followed by the employer's name. Fill in the employee's name, including their last name, first name, and middle initial.

- Indicate the city and state where the employee resides, ensuring you also complete the zip code field.

- Enter the name of the insurance carrier or self-insured entity. Complete the claims office mailing address for correspondence.

- In the disability information section, input the date of injury, the last day the employee worked, and the date the employee was able to return to work.

- Fill out the total days worked between the injury and the return-to-work date in the respective field.

- Move to the compensation information section. Report the compensation payments made under various categories such as TTD, TPD, PPD, and others, providing the respective number of weeks and total payment amounts.

- If applicable, complete the suspension of payments section, indicating the date of suspension and the reason for it.

- Finally, certify the information by signing the form, providing your printed name, title, and the date of completion.

- Once all fields are completed, you can save changes, download the form, print it, or share it as necessary.

Start filling out the 2015 AR4 Fillable Form online today to ensure timely submission and compliance.

If you are a part-year resident in Arkansas, you will need to fill out the 2015 Ar4 Fillable Form to report your income accurately. This form helps you calculate the tax owed for the period you resided in the state. You can easily access this form through the Arkansas Department of Finance and Administration website or platforms such as US Legal Forms. Using the correct form ensures compliance and simplifies your tax filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.