Loading

Get Nj State Ez Telefile Printable St 51 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj State Ez Telefile Printable St 51 Form online

Filling out the Nj State Ez Telefile Printable St 51 Form can seem daunting, but with clear guidance, you can complete it efficiently. This guide provides a step-by-step approach to help you fill out the form accurately and confidently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your designated editor.

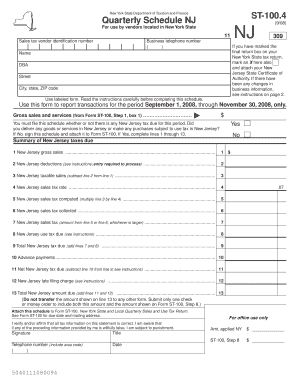

- Begin with the vendor identification number section. Enter your sales tax vendor identification number assigned by the state and your business telephone number, ensuring accuracy.

- Next, fill in the name of your business, including the DBA (Doing Business As) name if applicable. Provide the complete street address, city, state, and ZIP code of your business location in New Jersey.

- If applicable, mark the box indicating if this is your final return on your New York State tax return. If so, attach your New Jersey State Certificate of Authority.

- Continue by reporting your gross sales and services from Form ST-100, ensuring to enter the total amount accurately as it reflects your business activity during the reporting period.

- Follow the prompts to answer whether you delivered goods or services in New Jersey or made purchases subject to use tax. Mark 'Yes' or 'No' as appropriate.

- Complete the summary of New Jersey taxes due. Enter the required figures in each relevant field including deductions, taxable sales, sales tax rate, and the calculated sales tax due.

- Finally, review all entered information for accuracy. Once confirmed, sign and date the form. Save any changes you've made, and prepare to download or print the completed form for submission.

Start filling out your Nj State Ez Telefile Printable St 51 Form online today!

Certain entities and purchases are exempt from NJ sales tax, including non-profit organizations, government agencies, and specific types of food and clothing. To claim an exemption, you will need to present the appropriate documentation, such as the Sales Tax Exempt Certificate. For detailed guidance on exemptions, uslegalforms offers helpful resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.