Get Tiaa Cref Direct Rollover Form For Private

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tiaa Cref Direct Rollover Form For Private online

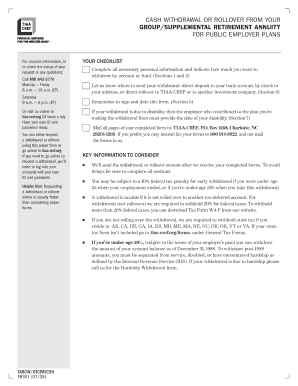

Filling out the Tiaa Cref Direct Rollover Form for Private is essential for ensuring your retirement funds are managed according to your preferences. This user-friendly guide will walk you through each step to complete the form accurately, facilitating a smooth rollover process.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to obtain the Tiaa Cref Direct Rollover Form for Private. This action allows you to access the document you need for processing your withdrawal or rollover.

- Provide personal and account information in Section 1. Fill in your first name, middle initial, last name, social security number, state or country of residence, and your TIAA number, which was provided earlier. Ensure that all information is accurate.

- In Section 2, indicate how much you wish to withdraw from your accounts. You can choose to withdraw the entire account balance or specify a dollar amount or percentage for a partial withdrawal. Make sure you know the account or fund numbers from the TIAA-CREF Account/Fund List.

- Select the withdrawal method in Section 3. You may choose direct deposit to your bank, a rollover to another TIAA-CREF account, a rollover to another investment company, or a paper check to your mailing address. If selecting direct deposit, provide your bank's name, address, account number, and routing number.

- If you are rolling over your withdrawal to another TIAA-CREF account, fill in the required details in Section 3B. Alternatively, for a rollover to another investment company, complete Section 3C, providing necessary account and company details.

- If applicable, complete the TIAA-CREF annuity loan repayment section. Indicate whether you want to repay your outstanding loan balance from the withdrawal request.

- Authorize your withdrawal by signing and dating Section 5. Ensure that you understand the implications of your withdrawal and that the information you provided is accurate.

- If your withdrawal is due to termination of employment or disability, complete Sections 6 or 7 as appropriate.

- Review your completed form thoroughly. After ensuring that all sections are filled out correctly, you may save changes, download, print, or share the form as needed.

Complete your Tiaa Cref Direct Rollover Form for Private online today to manage your retirement assets efficiently.

To perform a rollover from TIAA, you will first need to decide where you want to transfer your funds. Next, complete the TIAA Cref Direct Rollover Form For Private to initiate the process. Be sure to check for any potential tax implications and ensure your new account is ready to receive the funds. If you need more guidance, US Legal Forms can help provide the necessary documents to facilitate your rollover smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.