Loading

Get 15g Form Fill Up Procedure See Rule 29c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 15g Form Fill Up Procedure See Rule 29c online

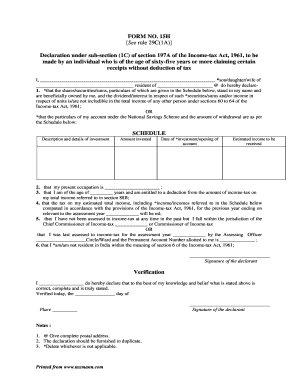

This guide provides a comprehensive overview of the 15g Form Fill Up Procedure as per Rule 29c. It is designed to assist users in completing the form correctly and efficiently, ensuring that individuals aged sixty-five and above can claim certain income without tax deductions.

Follow the steps to complete the form smoothly.

- Press the ‘Get Form’ button to access the 15g form and open it in your preferred document editor.

- Begin by providing your full name in the designated field, along with your relationship to the person mentioned, such as son, daughter, or partner. Ensure to complete the residential address section accurately.

- In the first declaration section, specify whether you own the shares, securities, or amounts stated in the schedule. If applicable, provide the details of investments including the amount invested, the date of investment, and the estimated income to be received.

- Indicate your present occupation in the specified section, followed by mentioning your age to confirm eligibility for tax deductions.

- State your estimated total income for the relevant assessment year, ensuring you calculate it according to the provisions of the Income-tax Act to confirm it is nil.

- If applicable, provide details regarding your past income tax assessment, including the assessment year and the name of the Assessing Officer.

- Declare your residency status in India based on the guidelines in section 6 of the Income-tax Act.

- Complete the verification section by providing your signature, the date, and the place. Ensure that all information is accurate and true.

- Review the entire declaration for accuracy. Any incorrect information could lead to legal implications, so ensure everything, especially relationships and amounts, is clearly stated.

- Once completed, you can save your changes, download the filled form, or print it for submission. Ensure to keep a copy for your records.

Complete your documents online today for a hassle-free experience.

To fill Form 29B online, access the appropriate website or platform that supports this process. Ensure you have all necessary details at hand, including your name and PAN. Follow the online prompts while adhering to the 15g Form Fill Up Procedure See Rule 29c. Using uslegalforms can simplify this process, offering you step-by-step guidance and ensuring accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.