Loading

Get Ky Dept Of Revenue Form 62a350

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ky Dept Of Revenue Form 62a350 online

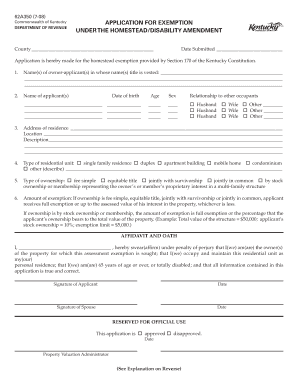

Filling out the Ky Dept Of Revenue Form 62a350 is an important step for individuals seeking a homestead exemption under the Kentucky Constitution. This guide provides straightforward and supportive instructions on how to complete this form online effectively.

Follow the steps to complete your application smoothly.

- Click ‘Get Form’ button to access the form and open it for editing.

- In the first section, provide the county name and the date you are submitting the application. This identifies the location of the property and the timeframe of your application.

- Complete the section regarding the owner-applicant(s). Enter the names in whose name title is vested. Ensure accuracy as this information is crucial for identification.

- In the next subsection, list the names of applicants along with their dates of birth, ages, and genders. Provide pertinent information about the relationship of each individual to the other occupants.

- Fill in the address of the residence accurately. This includes the full street address, location, and a detailed description of the residential unit.

- Select the type of residential unit from the provided options, which include options like single family residence, duplex, or condominium. If necessary, describe further in the space provided.

- Indicate the type of ownership pertaining to the property by choosing from options such as fee simple or joint ownership. This clarifies how the property is held.

- Provide the amount of exemption you believe applies according to your ownership type. Ensure that this aligns with the guidelines provided in the instructions.

- Sign and date the application to affirm its accuracy. If applicable, ensure your partner also signs and dates the document.

- Once you have completed the form, you can save your changes. Additionally, download, print or share the form as required to submit it to the property valuation administrator.

Start filling out your Ky Dept Of Revenue Form 62a350 online today for your homestead exemption.

To calculate property tax in Jefferson County, KY, you first determine the assessed value of your property, then multiply that by the local tax rate. Understanding any exemptions, like the homestead exemption, is vital in reducing your taxable amount. Homeowners can benefit from using specific forms, such as the Ky Dept Of Revenue Form 62a350, to ensure they maximize their tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.