Get St 120 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 120 Form online

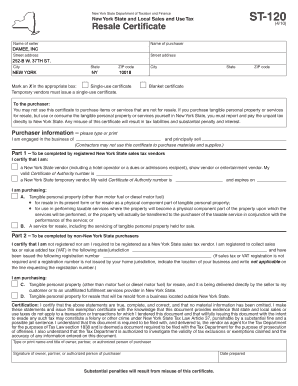

The St 120 Form, also known as the resale certificate, is an essential document for businesses in New York State looking to purchase items for resale without paying sales tax. This guide provides clear, step-by-step instructions to help users complete the St 120 Form online.

Follow the steps to complete the St 120 Form online.

- Click ‘Get Form’ button to obtain the St 120 Form and open it in the editing environment.

- Fill in the name of the seller and the purchaser. Ensure that the names are correctly spelled and formatted.

- Provide the street address, city, state, and ZIP code for both the seller and the purchaser. Make sure all details are complete and accurate.

- Select the appropriate box for the type of certificate: mark an X in either the 'Single-use certificate' or 'Blanket certificate' box based on your purchasing situation.

- In the 'Purchaser information' section, describe the type of business you are engaged in and what items you principally sell. Be specific to avoid any complications.

- Complete Part 1 if you are a registered New York State sales tax vendor. Include your valid Certificate of Authority number and specify what you are purchasing.

- If you are a non-New York State purchaser, complete Part 2. Indicate your registration information and where you are located if applicable.

- Ensure all sections are complete and that you have signed and dated the form. This certifies that the information provided is true and correct.

- Final steps: Save your changes to the form, and download or print it for submission. You may also share the completed form with the seller as required.

Take the next step and fill out your St 120 Form online today to streamline your resale purchases.

The NY ST-120 form is essentially the same as the ST 120 Form, used to claim sales tax exemptions in New York. It serves as a crucial tool for various organizations, including nonprofits and government agencies, to avoid unnecessary tax expenses. By utilizing the NY ST-120 form, you can ensure that your purchases are tax-exempt when applicable. This form is vital for maintaining accurate financial records and ensuring compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.