Get Delaware Form 5403 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware Form 5403 online

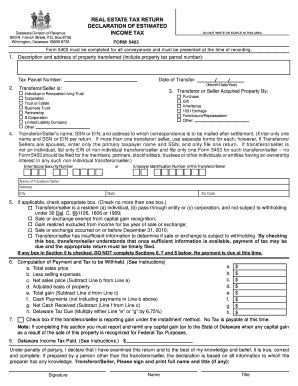

Delaware Form 5403 is essential for documenting real estate transactions and ensuring compliance with state tax regulations. This guide provides a clear, step-by-step process for completing the form online, catering to users of all experience levels.

Follow the steps to complete the Delaware Form 5403 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the description and address of the property being transferred. This should include the property tax parcel number.

- For the date of transfer, provide the month, day, and year of the transaction.

- Indicate whether the transferor/seller is an individual, corporation, or other type of entity by checking the appropriate box.

- Specify how the transferor/seller acquired the property by selecting the relevant option from the list.

- Provide the transferor/seller’s name, Social Security Number (SSN) or Employer Identification Number (EIN), and the mailing address for post-settlement correspondence.

- Check the appropriate box in Section 5 if applicable. Please ensure that only one box is checked.

- If Section 5 is completed, skip Sections 6, 7, and 8. Otherwise, proceed to calculate payment and tax to be withheld by completing Section 6.

- In Section 6, enter the total sales price, selling expenses, net sales price, adjusted basis, total gain, cash payments, net cash received, and Delaware tax due as specified. Choose either 'e' or 'g' to calculate the tax.

- If necessary, fill out Section 8 regarding Delaware income tax paid.

- Finally, under penalty of perjury, the transferor/seller must sign the form, print their full name, and include their title if applicable. Save changes, download, print, or share the completed form.

Complete the Delaware Form 5403 online today to ensure your real estate transaction is documented correctly.

Yes, Delaware taxes non-residents on income derived from sources within the state. If you're a non-resident earning income in Delaware, you are required to file a tax return, typically using Delaware Form 5403. It is essential to understand your tax obligations, as non-residents may be taxed differently than residents. Consulting with uslegalforms can help clarify any questions regarding filing for non-resident income.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.