Loading

Get Chesapeake Military Spouse Residency Affidavit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chesapeake Military Spouse Residency Affidavit Form online

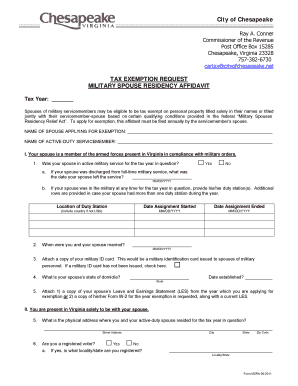

Filling out the Chesapeake Military Spouse Residency Affidavit Form is an essential step for military spouses seeking tax exemption on personal property. This guide provides clear and detailed instructions to help you complete the form efficiently online.

Follow the steps to complete the affidavit accurately.

- Click the ‘Get Form’ button to obtain the Chesapeake Military Spouse Residency Affidavit Form and open it in your preferred editor.

- In the first section, enter the name of the spouse applying for the exemption, followed by the name of the active-duty servicemember.

- Answer the question regarding your spouse's active military service for the tax year by selecting 'Yes' or 'No'. If 'No', indicate the discharge date if applicable.

- Provide the details of your spouse's duty stations, including location, start date, and end date of assignment.

- Enter the date of your marriage and attach a copy of your military ID card. If you do not have one, check the provided box.

- List your spouse’s state of domicile and provide the requested documentation, such as the Leave and Earnings Statement or W-2 for the relevant tax year.

- In the section regarding your presence in Virginia, fill in your current physical address with your spouse and indicate if you are a registered voter, along with the locality/state.

- Provide your state of domicile and the last physical address you resided at that state. Attach supporting documents proving your domicile.

- List all personal property located in Chesapeake for which you are seeking exemption, including all pertinent details such as title number and vehicle identification.

- Finally, complete the affidavit by signing it, providing your printed name and current address, along with your daytime telephone number.

- If necessary, arrange to have the affidavit notarized, ensuring that it is properly signed in front of a Notary Public.

- Once all sections are completed, save your changes, download, print, or share the form as needed.

Complete your Chesapeake Military Spouse Residency Affidavit Form online today for an efficient filing experience.

The new law opens the door to service members and their spouses to pick the state in which they pay income taxes from three options: the legal residence or domicile of the service member; the legal residence or domicile of the spouse; or the current permanent duty station of the service member.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.